Five fraudsters who offered a ‘green' tax efficient investment scheme to wealthy investors in order to steal millions from them have been ordered to pay £20,611,738.

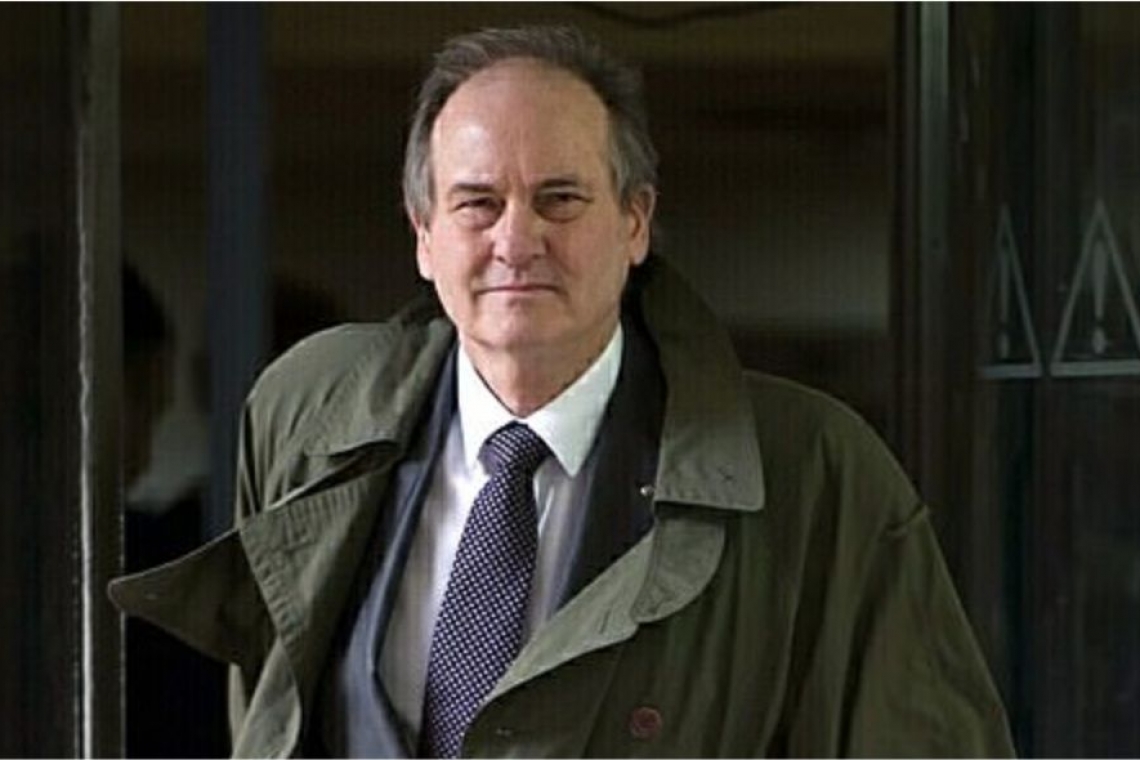

The Oxbridge alumni used their former positions as a conductor of the Vienna Philharmonic Orchestra, a solicitor and merchant banker to persuade wealthy investors to put money into their ‘green’ investment scheme.

Investors were told their money would be spent on research and development into carbon credits, but only £16 million of the £65 million was actually spent on planting trees.

Instead the group stole £20 million of the investors’ money and laundered it via bank accounts and secret trusts, spending it on luxury properties in London, Australia and Dubai as well as hidden off-shore investments. They also failed to pay around £6.5million in tax.

On Friday 13 December at the Old Bailey, Michael Richards, Rodney Whiston-Dew and Evdoros Demetriou have been ordered to pay £17.7 million collectively and if they fail to return the funds in the next three months, they face further time in jail. At an earlier hearing Robert Gold and Jonathan Anwyl were ordered to repay £2.64 million and £253,934 respectively.

Manjula Nayee of the CPS said: “These men used their elite background to persuade people to part with their money, resulting in a huge loss to the victims and the public purse.

“Seizing these assets shows that we will do everything we can to ensure that criminals do not profit by exploiting others.”

The criminal benefit

To determine how much these men had profited from their scam ‘green’ scheme, the prosecution had to consider issues around ownership of different properties, international trusts, the corporate veil, tainted gifts as well as the effect of inflation, given the offences happened over 12 years ago.

They had laundered the proceeds internationally, hiding funds in accounts across China, the British Virgin Islands, Greece and Switzerland, which all had to be taken into consideration as part of the confiscation proceedings.

The vast amount of evidence gathered to support the case for their benefit amounts resulted in an opening argument of more than 100 pages for a heavily contested hearing which lasted two weeks.

The defence presented materials to show that each money launderer had little in the way of available assets, but the CPS was able to show these claims were false by identifying £20,611,738 of available assets.

Manjula Nayee continued: “It is thanks to the dedication of every member of the prosecution team that worked on this case that, we could be confident the defendants had nowhere to hide. Now they must pay the millions they owe or face further time in jail.”

Notes to editors

Manjula Nayee is a Specialist Prosecutor in the CPS Proceeds of Crime Division

Sentencing details:

Michael Richards (04/01/1962) was convicted in November 2017 of a conspiracy to cheat the public revenue, and also cheating the revenue in relation to his personal tax liability. He was sentenced to a total of 11 years' imprisonment and disqualified from being a company director. He has been ordered to pay £9,999,999 within three months or he faces an additional 10 years added onto his existing sentence.

Robert Gold (28/01/1968) was convicted in November 2017 of a conspiracy to cheat the public revenue, and also cheating the revenue in relation to his personal tax liability. He was sentenced to a total of 11 years' imprisonment and disqualified from being a company director. He has been ordered to pay £2.6 million within three months or he faces an additional nine years added onto his existing sentence.

Rodney Whiston-Dew (26/06/1951) was convicted in November 2017 of a conspiracy to cheat the public revenue, and also cheating the revenue in relation to his personal tax liability. He was sentenced to a total of 10 years' imprisonment and disqualified from being a company director. He has been ordered to pay £3,035,192.97 within three months or he faces an additional nine years added onto his existing sentence.

Jonathan Anwyl (7/10/1973) was convicted in November 2017 of a conspiracy to cheat the public revenue. He was sentenced to a total of five and a half years' imprisonment. He has paid his £253,934 order.

Evdoros Demetriou (15/6/1939) was convicted in November 2017 of a conspiracy to cheat the public revenue. He was sentenced to a total of six years' imprisonment and disqualified from being a company director. He has been ordered to pay £4,682,613 within three months or he faces an additional nine years added onto his existing sentence.